Climate Change Risks Demand Urgent Financial System Reforms

It is estimated that by the year 2100, India could face an annual GDP loss of 3% to 10% due to climate change, says RBI’s Rajeshwar Rao

Climate Change Risks Demand Urgent Financial System Reforms

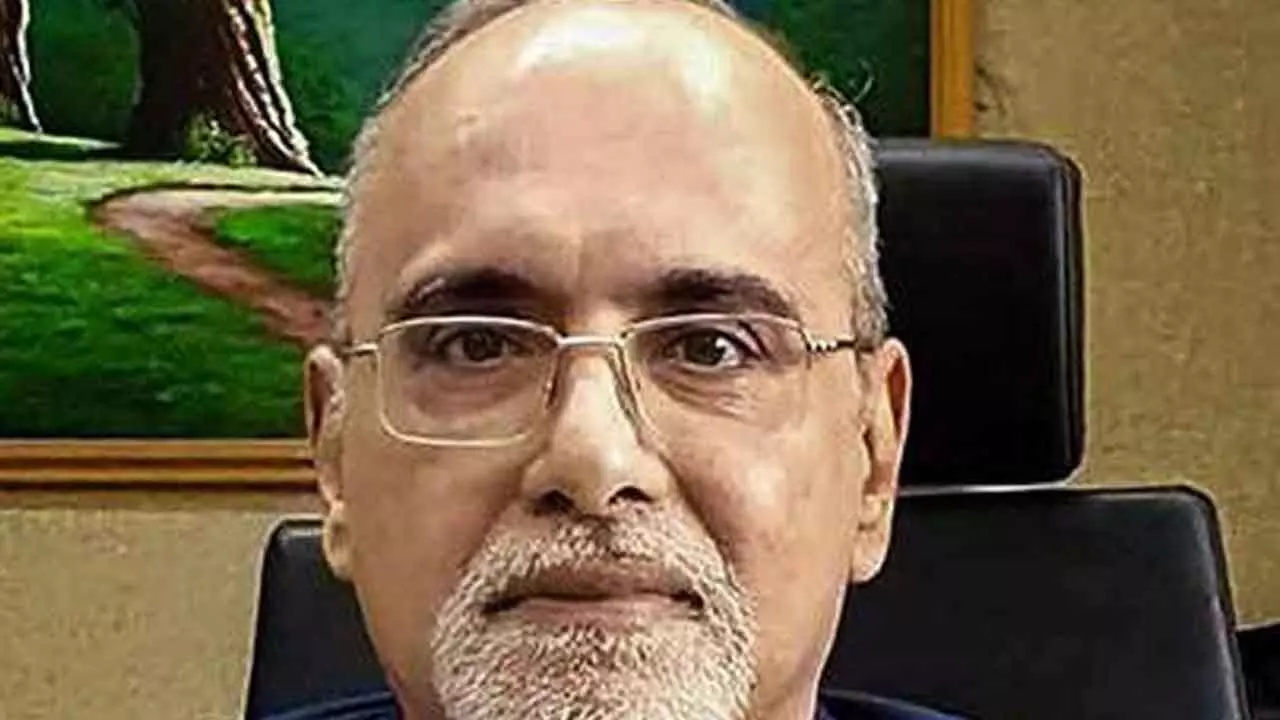

Climate change risks have started to impact the financial system and it is essential to build capabilities to ensure correct assessment of these risks and put in place suitable adaptation and mitigation measures, the Reserve Bank of India (RBI) Deputy Governor M Rajeshwar Rao has said, stressing the need for India-specific data that can be based on globally accepted range of scenarios.

Currently, the biggest challenge faced by emerging markets like India and developing economies is lack of adequate financing for development of sustainable technologies and requisite infrastructure to mitigate and adapt to climate change and build a robust sustainable financial system.

“India looks to be particularly vulnerable to climate change given its geographic location. It is estimated that by the year 2100, climate change could lead to an annual GDP loss of 3 per cent to 10 per cent,” Rao noted in an RBI paper, titled ‘Mitigating Climate Change Risks and Fostering a Robust Ecosystem for Sustainable Finance’.

While there is some debate on whether or not climate change is part of a mandate for a Central Bank, the fact that it has a bearing on both price and financial stability means that there is a need for a regulatory response on risks arising from climate change, he maintained.

The Central Bank has been proactive in its resolve to assess and mitigate the climate change risks that may impact the financial system.

“Over the last few years, we have taken several incremental measures in this direction. It started with the setting up a dedicated group within the Bank to assess climate change risks and foster a robust ecosystem for sustainable finance,” said Rao.

This was followed by release of survey on climate risk and sustainable finance covering 34 scheduled commercial banks, discussion paper on climate risk and sustainable finance, followed by release of framework on green deposits.

He said climate data is characterised by lack of uniform methodology, fragmentation in accessibility, lack of uniformity in publication of data and difference in metrics, units, and formats.

“There is lack of actual historical loan loss data related to climate risks, hazard data encompassing historical and future forecasts of occurrences of climate events, and sectoral benchmarks for transition to net zero. Currently there is no set practice among financial institutions of labelling loan assets which have gone bad basis any climate risk event,” Rao highlighted.